What is a Cryptomixer? How to Get Started with Bitcoin Mixing

-

Last updated: 2025-07-30

What is a Crypto Mixer?

Crypto mixer, also known as a crypto tumbler, is a crypto service that conceals the traces of Bitcoin transactions and thus increases the privacy of customers. This procedure aids users in achieving a certain degree of privacy and anonymity by obfuscating the origins and owners of funds. Given that most public blockchains, including Ethereum and Bitcoin, are transparent, achieving privacy without a crypto mixer can be difficult. Crypto Mixer apps are helpful for mixing your Bitcoin at any time. However, these cannot usually be downloaded from the google play store.

Why are Crypto Mixers used?

Crypto mixers are primarily used to preserve privacy and conceal the sender's identity during crypto transactions. They serve as a crucial tool to anonymize these transactions in certain circumstances.

For one, many users of mixers live in countries like North Korea with oppressive regimes, making open and transparent transactions on the blockchain potentially dangerous. These include outspoken journalists, members of opposition parties, or regular civilians risk retribution for the purpose of articulating conflicting perspectives or convictions.

The statistics from chainalysis show that almost 10% of all Bitcoin has already passed through a Bitcoin mixer. This proves the importance of crypto mixers for the preservation of privacy and the protection of individuals from repressive regimes.

Further, investigative journalists, activists and whistleblowers can leverage crypto mixers effectively. In a profession where the safety of sources is paramount, crypto mixers allow for a safe way to transfer payments for crucial information across borders while keeping identities concealed.

How Do CryptoMixer Works?

Crypto mixers utilize a sophisticated method to combat the transparency that comes with blockchain transactions. When you carry out a transaction on the Bitcoin or Ethereum network, for instance, traces are left behind that tell where the funds originated and where they were sent. This is where a crypto mixer intervenes.

A bitcoin mixer or cryptomixer blends a user's cryptos with those deposited by other users. The service mixes all the coins together and then sends the original amount back to the user, minus a small fee. The coins received after mixing have broken ties with their previous transaction history, making it tough to trace the origin. This is much like exchanging marked banknotes for unmarked ones.

The mixing process does not require any accounts or personal details, maintaining the whole anonymity vibe. For maximum security, reliable mixers use advanced encryption methods, making them safe havens for users seeking privacy.

Different Types of Crypto Mixers: Centralized vs Decentralized

There are two main types of crypto mixers – centralized and decentralized.

Centralized mixers are operated by a third-party service provider who takes control of your funds during the mixing process, essentially managing the whole process for you. All you need to do is send your funds to the mixer's wallet, pay a service fee, and specify the receiver address. The mixer will then pool your funds with those of other users, and redistribute them, thereby breaking the connection between your coins and their past transaction history.

Decentralized mixers on the other hand, use a peer-to-peer network and smart contracts to facilitate the mixing process, eliminating the need to trust a single entity. They rely on an automatic permissionless system that mixes transactions amongst multiple users. However, they can be more difficult to use than their centralized counterparts, as they require active user participation.

The cointelegraph writes the following:

Centralized services are obviously more accessible and more approachable. However, they will have access to your Bitcoin and IP addresses. Hence, they are not the most private service in the world. Decentralized mixers can be a little less approachable, but they are a lot more private.

What is Coinjoin?

CoinJoin is a method used for anonymizing Bitcoin transactions. It was first proposed by Gregory Maxwell, a Bitcoin Core developer, in 2013 as an answer to the growing concerns of privacy issues on the Bitcoin network.

CoinJoin operates by consolidating multiple transactions from different users into one large transaction. This act of consolidation makes it increasingly difficult to identify which addresses the Bitcoins are coming from and where they're going to. In a nutshell, CoinJoin works by jumbling up everyone's transactions, effectively providing anonymity to all participants.

This simplified diagram shows how Coinjoin works:

The most common Coin Mixer fees

Most cryptocurrency mixers charge a small service fee for their operations.

Here you can see a list of the most common fees:

Service fees

Network fees

Time delay

Confirmations required

1% - 5%

0.0003 BTC

Instantly - 72 hours

1

Top CoinJoin Tumbler and Coin Mixer

The largest already closed CoinJoin tumblers and crypto mixers included ChipMixer, CryptoMixer, Tornado Cash and Bestmixer.

- Coinomize: It is one of the top-rated Bitcoin tumbling services in 2025, boasting a 4.9/5 user rating over 1,137 reviews on the dark web. Its features include a user-friendly interface, a record for secure and reliable mixing services, and competitive service fees. Coinomize.biz makes coins untraceable by mixing them with other coins and returning new coins back to the original sender.

- ChipMixer: This is one other reliable Bitcoin mixer and one of the oldest. It uses standard mixing processes, returning coins in a randomized order and non-standard amounts to throw off anyone attempting to trace the transactions.

- BitMix: Supports two types of cryptocurrencies, with Ethereum expected to be supported soon. It allows users to set a time-delay feature up to 72 hours and gives senders the option to divide the transactions, ensuring the funds are sent to multiple addresses to make detection more difficult.

- Bestmixer: This mixer has also supported two types of cryptocurrencies and makes this list for its speed, trustworthiness and low transaction fees. The platform also offers a coin splitting service that splits the deposited coins across 5 addresses, further increasing the anonymity of users.

Here are some 5 star reviews from Trustpilot and Bittrust what people write about Coinomize:

The best mixer I have ever used. Good prices, fast technical support, the best in the business.

One of the best mixers I've used. Never had a problem with Coinomize. Fast support and transactions will be sent immediately after time delay.

Coinomize is the Best Bitcoin Mixer in 2025 since 2019 :)

Are Crypto Mixers Legal? - Enforcement Actions and Criminal Charges

The legality of bitcoin tumbler is a topic of much debate and vastly depends on the jurisdiction and the nature of use. Despite their potential misuse for illegal activities such as money laundering and financing of illicit transactions, crypto mixers are not explicitly illegal in most jurisdictions.

To sum up, while crypto mixers may not be outright illegal, they are under scrutinized regulation due to their potential misuse in financial crimes. Using them responsibly and within the law can serve a vital role in safeguarding financial privacy.

Achieving Financial Privacy with Crypto Mixers

Financial privacy is a cornerstone of economic freedom, especially in a digital age where most financial transactions can easily be linked with an identity. This is where crypto laws and crypto mixers come in. They add an extra layer of privacy by disguising the origins and destinations of cryptocurrencies, making your financial transactions with various currencies hard to trace.

Here is how crypto mixers help in achieving financial privacy:

- Anonymity: Crypto mixers break the link between the sender and receiver in a blockchain transaction, making you anonymous to any party trying to trace your online activities.

- Safety: Using crypto mixers protect you from potential threats that might be associated with your transactions. If you are paying for a sensitive service (like a VPN) or are a political activist working in a high-risk environment, crypto mixers can provide an invaluable layer of safety.

- Cross-border payments: Crypto mixers make it possible to send money across borders anonymously, making it an excellent tool for people living under authoritarian regimes.

- Protection from third parties: Crypto mixers protect you from fraud or other malicious intent by hiding your financial transaction history.

- Preventing targeted attacks: Crime can often be a by-product of wealth. By masking your wealth with a crypto mixer, it is more difficult for potential thieves or hackers to target you.

We are fully dedicated to our policy of not keeping any logs. Our priority is to guarantee the utmost privacy and security for our users by not recording their activities.

Whats are Crypto Anonymizers?

Crypto anonymizers are tools and tactics aimed at obfuscating or completely masking the traces of cryptocurrency transactions. They are designed to ensure your transactions remain private by hiding transaction origin, destination, and amount. Crypto mixers fall into this category.

Crypto anonymizers employ diverse methods to ensure this privacy. Besides mixing, some anonymizers use cryptographic techniques, such as zero-knowledge proofs and ring signatures, to provide anonymity. Additionally, some cryptocurrencies like Monero and Zcash are built from the ground up with privacy and anonymity as a key feature.

Your Step-by-step Guide on How to Use a Crypto Mixer

Step 1: Find a safe and reliable instant coin mixing service

Before you start mixing coins, it's essential to find a reliable and secure crypto mixer. You should keep in mind that not all crypto mixers are created equal. Some may offer superior privacy features, while others might have a reputation for being secure and trustworthy.

Look for online reviews, forums, or community discussions on platforms like Reddit or Twitter to gauge user experiences with various mixers. Well-respected mixers will have evidence of a strong track record and positive user testimonials. Because there are many scams.

A key feature to look for is if the service deletes transaction logs after a specific period (usually 24 hours for most trustworthy mixers). Also, ensure they use advanced encryption methods for additional security. Services like Coinomize, Cryptomixer.io, and BitMix are some of the reputable mixers with proven track records for reliability and security.

Remember, the priority is to ensure the mixing service is legit and safeguards your privacy, security, and confidentiality to the utmost extent possible.

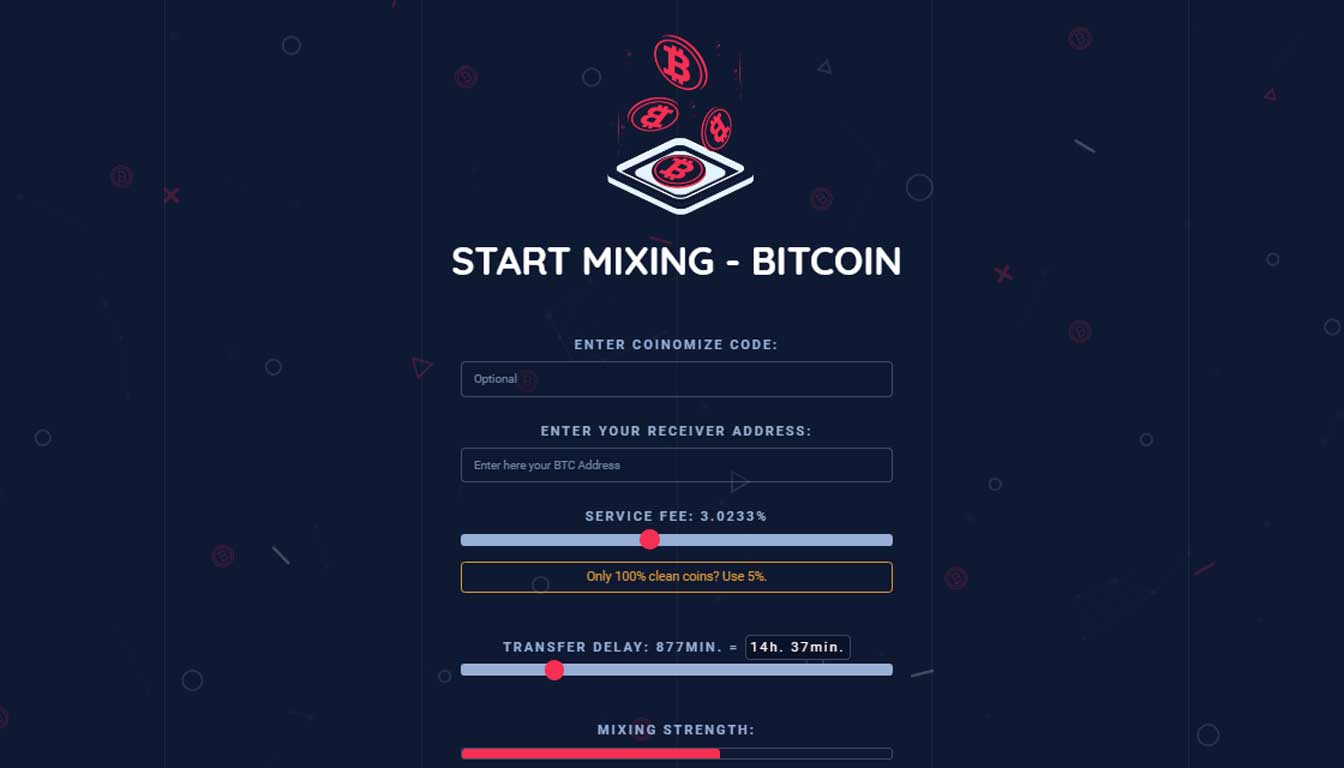

Step 2: Visit the Mixing page and set the settings

Once you've chosen a reliable mixing service, the next step is to visit their website and navigate to the mixing page. Avoid websites where site registration is required, as they often save your data.

This process involves specifying the details of how you want your coins mixed. Usually, you will need to select the cryptocurrency type you want to mix (Bitcoin, Ethereum, etc.) and enter the amount of cryptocurrency you want to mix.

Among the settings you can customize are:

- Delay: You can choose to delay the processing of your transaction in the mixer. This delay can range from immediate processing to several hours or more, further helping to obscure the mixing process.

- Distribution: You can set the distribution of your mixed cryptocurrency to multiple output addresses. Splitting your mixed coins into multiple wallets can provide an additional layer of privacy.

- Mixing Code: This is a unique code you enter or let the system generate for you. This random and unique mixing code is used for each transaction, allowing you to differentiate your coins from previous mixes, ensuring they don't get sent back to you in future mixings.

Make sure to configure these settings to meet your specific privacy needs, including the protection and handling of user data. After entering the required information, you are then ready to proceed to the next step. Beginning at just 1% + 0.0003 BTC, our fees can be tailored in such a way that it becomes difficult for external entities to detect any link between addresses.

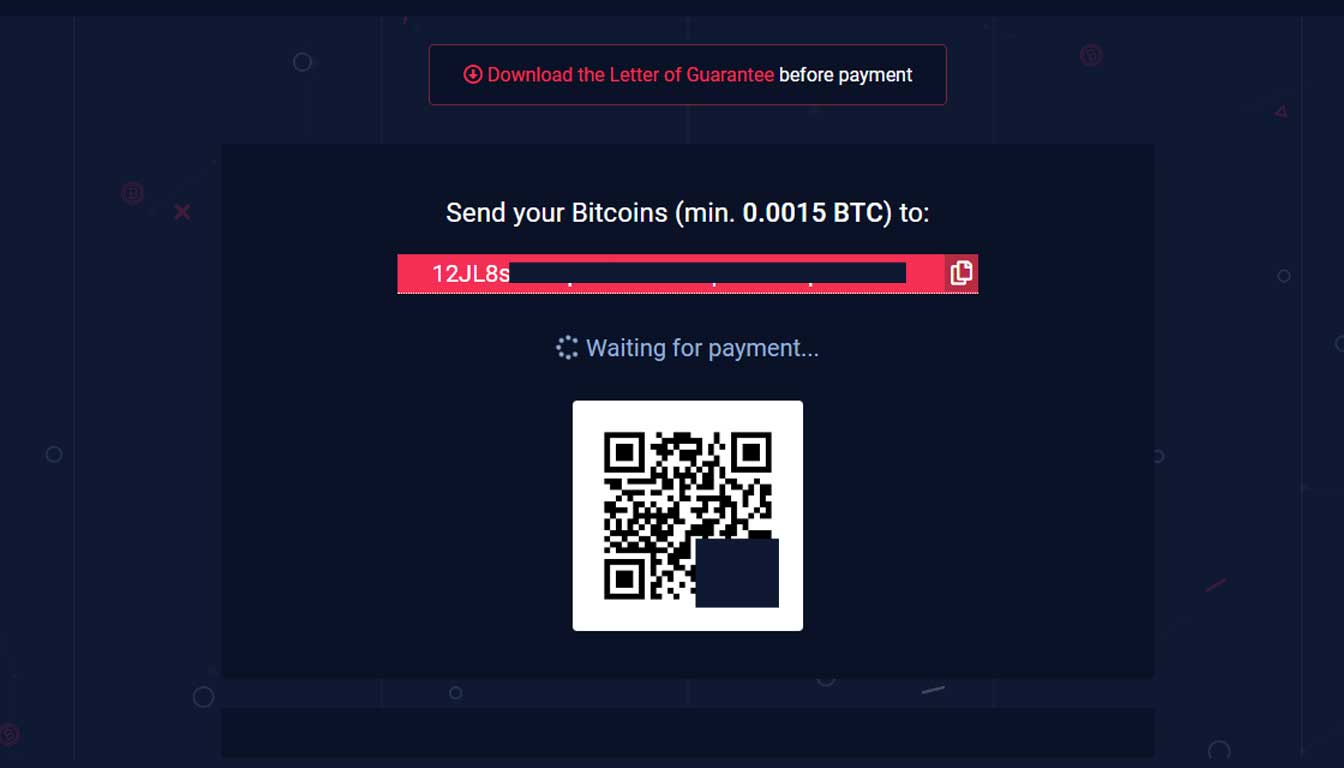

Step 3: Follow the Instructions

After setting your preferred options, you'll need to follow the instructions provided by the mixing service. Most crypto mixers (also known as blenders) feature an intuitive user interface and provide clear instructions to guide you through the process.

Typically, the service will display a unique destination address for user deposits to which you need to send your coins. Send the coins from your wallet to this address to start the mixing process.

Step 4: Start MIXING

Once you've followed the instructions and sent your cryptocurrency to the specified address provided by the mixing service, you can initiate the mixing process.

When the mixing service receives your coins, they join a large pool of other users' funds and reserves. The service will then proceed to blend or 'mix' your currency with the other users' coins over a specified period.

Remember that the duration of this server process can differ based on several factors, including the amount you're mixing, the current network congestion, and the delay time you configured.

Most services will provide a status update or progress bar indicating the progress of the mixing process and withdrawals. Once the mixing process is complete, the service will disburse the mix of coins to the specified wallets, leaving no trace of your original coins.

Step 5: Withdrawing and Transferring Bitcoins After Mixing

After the mixing process is complete, the mixed coins will be sent to your specified output addresses as recipients. This marks the final step in the mixing process.

As with all transactions on the blockchain, you'll want to double-check for confirmation to ensure the correct receipt of your funds. The reliable mixing services usually provide proofs of transactions or mixing for you to verify the entire process.

What is Anti-Money Laundering (AML)?

The purpose of Anti-Money Laundering (AML) is to deter criminals from concealing unlawfully acquired funds as lawful earnings, through a series of laws, regulations, and procedures. Introduced in 1970 as part of the Bank Secrecy Act (BSA) in the United States, anti-money laundering (AML) laws mandate that financial institutions aid government agencies in identifying and thwarting money laundering activities.

Under AML measures, financial institutions are obligated to maintain a ledger that records all financial transactions like:

- Conduct 'Know Your Customer' (KYC) Checks: This means identifying and verifying the identity of their clients to curb fraud.

- Report Suspicious Activities: Institutions must report activities that appear suspicious and could signal money laundering, tax evasion, or other financial crimes.

- Maintain Records: Insitutions must keep detailed financial records of transactions to aid in potential investigations of money laundering.

- Implement an AML Program: Regulated entities must establish and implement a compliance program to detect, prevent, and report potential money laundering activities.

Do crypto mixers check the AML value?

Crypto mixers, by their very nature, are designed to improve anonymity and therefore do not typically perform Anti-Money Laundering (AML) checks, such as Know Your Customer (KYC) procedures. Their primary function is to obscure the traceability of cryptocurrency transactions, meaning any form of identity verification would contradict this purpose.

While crypto mixers can provide privacy benefits, it is crucial to use them in a responsible and legal manner. Always make sure you are acting within the legal guidelines of your jurisdiction when using any service that provides financial anonymity.

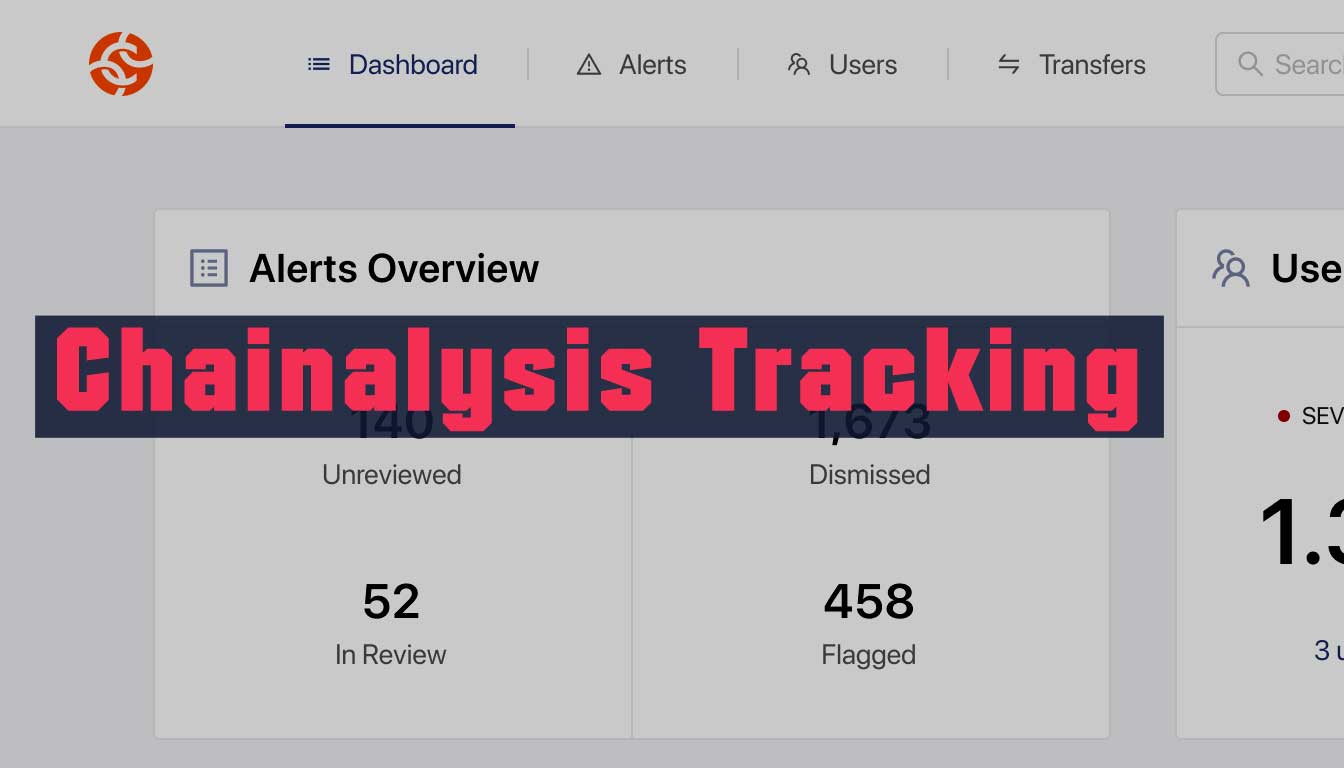

How does Chainalysis help in tracking Bitcoin transactions?

Chainalysis is a leading blockchain data platform that provides investigation and compliance tools to businesses, governments, and law enforcement agencies to engage confidently with cryptocurrencies. It helps track Bitcoin transactions, among others, by analyzing the blockchain for transaction patterns, addresses, and other relevant information.

By using advanced blockchain analysis techniques, Chainalysis can categorize and map out blockchain transactions and link them to real-world entities. It uses data from open sources and proprietary data to create cluster addresses owned by the same entity, thereby identifying high-risk transactions.